Uninsured & Underinsured Motorist Accident Lawyers Cherry Hill, NJ

Attorneys Advocate for Clients Injured in Uninsured & Underinsured Motorist Accidents in Camden County, Burlington County & Across NJ

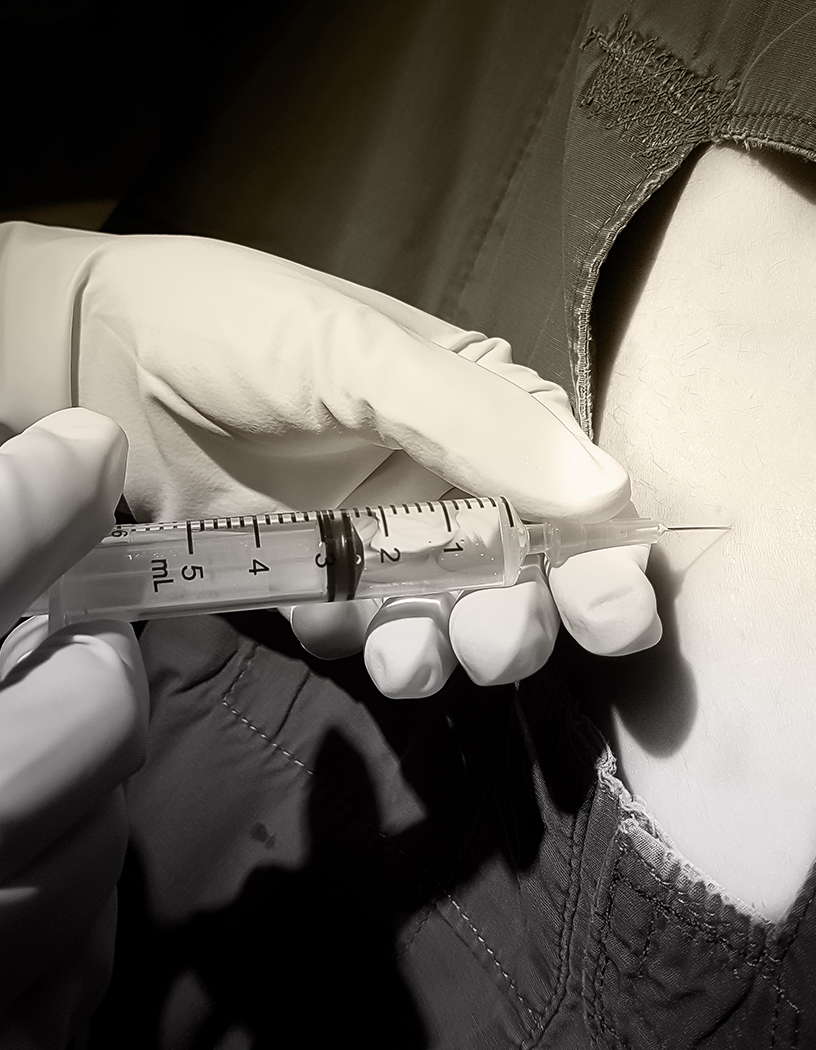

Car accidents often have the potential for causing serious injuries to the occupants of the vehicles involved. Unfortunately, when an accident causes significant injury to the occupants of the vehicle not at fault for the accident, the costs of treating those injuries can exceed the limits of the responsible party’s insurance policy. In addition, in some cases, the responsible party may flee from the scene of an accident before anyone can determine their identity. When the responsible party doesn’t have significant personal assets to pay a court judgment for the full extent of medical expenses or flees the scene before their identity can be determined, an injured party would be left without the ability to obtain compensation.

Many clients who are injured in an accident where the responsible party’s insurance coverage isn’t enough to cover medical expenses, lost wages, and other damages may feel as though they are stuck in a perilous financial situation. The personal injury attorneys of Andres, Berger & Tran can help you or your loved one injured in a motor vehicle accident through no fault of their own seek further compensation for damages and injuries from your own auto insurance policy’s uninsured/underinsured motorist coverage. This coverage can also pay for your damages and expenses when the at-fault driver isn’t available to pay damages, or their insurance and other financial means are insufficient to cover the full extent of your expenses. Our award-winning personal injury attorneys have a proven track record of helping our clients obtain the maximum compensation possible for injuries they’ve suffered in motor vehicle accidents in South Jersey and throughout the state of New Jersey.

Clients Injured by Uninsured and Underinsured Motorists in Mount Laurel, Marlton, and Across South Jersey Can Still Recover Compensation

However, New Jersey insurance statutes require automobile insurance policies to provide uninsured/underinsured motorist coverage (or UM/UIM coverage) of at least $15,000 per person and $30,000 per accident. The statutes also require insurers to offer policyholders the opportunity to purchase up to $250,000 per person/$500,000 per accident in uninsured/underinsured coverage, not to exceed the primary limit of the policy. Uninsured motorist coverage is paid out when the responsible party for an accident does not have their own insurance policy or flees from the scene of an accident before the injured party can discover their identity. Underinsured motorist coverage is paid out when a responsible party has an insurance policy, but the injured party’s expenses exceed the limit of that policy. UM/UIM coverage can provide compensation for many of the same kinds of expenses and damages that you could recover from the at-fault driver for. However, your insurance company will only pay up to the limit of your UM/UIM coverage; in some cases, your damages and expenses may exceed the limits of your UM/UIM policy.

Attorneys at Andres, Berger & Tran Provide Experienced Legal Representation Following an Accident with an Uninsured or Underinsured Motorist in Cherry Hill, NJ

Obtaining legal representation when you are injured by an uninsured or underinsured motorist is critical to obtaining the compensation you are entitled to. In some cases, your insurance company may try to pay you less than the full amount of your UM/UIM policy or less money than your total expenses. Or the insurance company may try to get you to sign over your right to pursue a claim against the responsible driver.

At Andres, Berger & Tran, we work tirelessly to get our clients the maximum compensation possible for their injuries. We recognize that, in many cases, the at-fault driver isn’t available to answer our client’s legal claims or doesn’t have the insurance and financial resources necessary to cover all our client’s damages. In those cases, our clients may be able to seek further compensation for their injuries from their own insurance company. Our experienced personal injury attorneys can explain the option of submitting a UM/UIM claim to your auto insurance company, help you through the process of submitting a claim, negotiate with your insurance company for the maximum possible compensation, and advise you of your legal options and rights following a UM/UIM claim.

Contact a Personal Injury Attorney Today to Discuss Your Haddonfield, NJ Uninsured/Underinsured Motorist Accident Case

Our South Jersey personal injury attorneys are ready to help you when the party at fault for your accident lacks the insurance and financial resources to fully compensate you for your injuries and damages. Even when you make a UM/UIM claim against your insurance policy, there are often still questions about how much compensation you may be entitled to under your policy and whether you will still be able to pursue compensation from the driver responsible for your accident. If you or a loved one have been injured in a motor vehicle accident in South Jersey contact the offices of Andres, Berger & Tran today for a consultation on your case.

Frequently Asked Questions About Uninsured & Underinsured Motorist

Uninsured/underinsured motorist coverage will cover most of the same categories of expenses that you would be entitled to recover from the at-fault party, including:

-Medical expenses

-Lost wages

-Pain and suffering

-Emotional distress

However, keep in mind that even with uninsured/underinsured coverage, you may not be able to recover all of your expenses — you will only be entitled to recover up to the maximum limit of your UM/UIM policy.

Featured Results